Markets feel chaotic in the moment. Crashes seem sudden, bubbles look irrational, and recoveries often appear like miracles. But history tells a different story: financial markets move in cycles—predictable, almost rhythmic patterns that have repeated for over 150 years.

What if I told you there’s a map—a historical blueprint—that not only explains every major boom and bust but also gives us strong clues about where we’re heading in 2025?

The Cycles Hidden in Plain Sight

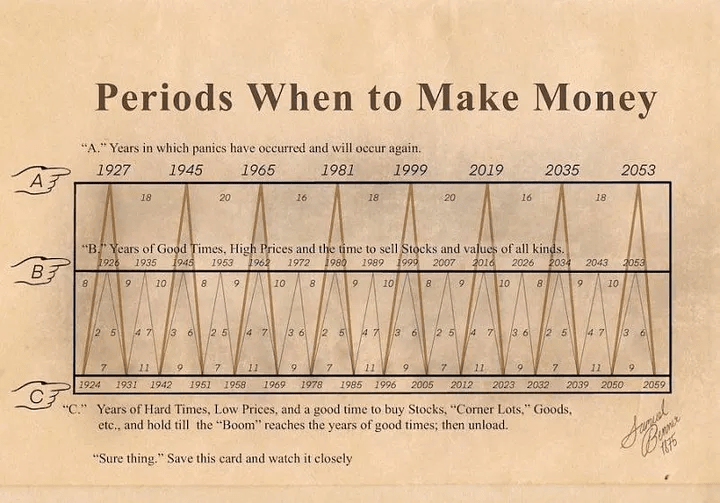

When you zoom out far enough, short-term noise disappears, and long-term patterns emerge. Economists and historians have tracked several recurring cycles, but three stand out:

- Kondratiev Waves (40–60 years): Long cycles driven by technological revolutions and infrastructure buildouts. Steam, railroads, electricity, oil, the internet—all sparked massive booms, followed by crashes.

- Kuznets Cycles (15–20 years): Linked to investment in housing, demographics, and migration.

- Juglar Cycles (7–11 years): Classic business cycles of expansion and recession.

Overlay these cycles on a 150-year market map, and something fascinating happens: the Great Depression (1929), Dot-Com Bust (2000), Global Financial Crisis (2008), and even the COVID crash (2020) all align almost perfectly with these waves.

History may not repeat exactly, but it certainly rhymes.

Every Crash, Every Time

- 1929 Crash & Depression: The end of a Kondratiev wave powered by industrial expansion.

- 1970s Stagflation: A cycle peak fueled by post-WWII rebuilding, ending in inflation and oil shocks.

- 2000 Dot-Com Bubble: A tech-driven Kuznets-Juglar alignment that snapped under its own weight.

- 2008 Financial Crisis: A Kuznets housing cycle collapse, amplified by financial engineering.

- 2020 Pandemic Shock: An external trigger landing right at the tail of a Juglar cycle.

The map isn’t magic—it’s math + psychology. Human behavior (fear, greed, over-confidence) drives markets the same way it did a century ago. Combine this with debt cycles, demographics, and technology shifts, and the rhythm becomes clear.

So What About 2025?

If history holds, 2025 looks like the intersection of two powerful forces:

- Debt & Liquidity Squeeze

The last decade was defined by cheap money and explosive debt. Rising interest rates now act as a global stress test. Historically, debt bubbles unwind painfully—2025 could mark the breaking point. - Tech Hype vs. Reality

AI, blockchain, and green tech are driving a new Kondratiev-style boom. But every tech revolution has its bubble phase before real adoption matures. The “AI everything” narrative feels eerily similar to the 1999 internet euphoria. - Geopolitical Fractures

Major wars, supply chain realignments, and the de-dollarization trend are reshaping global finance. History shows that market shocks often align with geopolitical stress.

Put simply: the 150-year map suggests that 2025 won’t be just another year—it could be the pivot point of the next great reset.

How to Think About It

The point isn’t doom-scrolling or fear. It’s preparation.

- Crashes aren’t endings—they’re transitions.

- Every market bust of the last 150 years created the foundation for the next growth wave.

- The winners aren’t those who avoid volatility but those who understand it and position wisely.

If the map is right, 2025 may bring turbulence—but also once-in-a-generation opportunities.

Final Thought

The 150-year market map isn’t a crystal ball. It’s a reminder that cycles, not randomness, drive history.

We’ve seen this movie before—every crash, every recovery, every new boom. And if the patterns hold, 2025 could be one of the most decisive chapters yet.

The real question isn’t whether the storm is coming. It’s whether you’ll be prepared to navigate it.