Bitcoin’s Breakout Era

Inside the Institutional Wave Reshaping the Global Financial Order

For over a decade, Bitcoin has been dismissed, praised, feared, and idolized—often all at once. But what lies ahead could dwarf everything we’ve seen so far. The next five years won’t just be about price surges or speculative hype. They’ll be about a tectonic shift in global finance, institutional power, and digital ownership—and Bitcoin is set to sit at the epicenter.

Let’s explore why the coming half-decade could redefine not only how we see money, but how we own, transfer, and build wealth in the digital age.

1. Institutional Power Will Reshape the Playing Field

The biggest story of the next five years won’t be retail traders or crypto-native startups—it will be institutions moving in with scale, sophistication, and strategic patience.

- Pension funds, sovereign wealth funds, and insurance giants are quietly allocating small but growing percentages of their portfolios to Bitcoin.

- Spot Bitcoin ETF products are making it easier than ever for traditional investors to gain exposure without the complexities of self-custody.

- Global banks are developing digital asset custody and settlement infrastructure, embedding Bitcoin into the same pipes that move trillions in bonds and equities daily.

This institutional wave brings stability, regulatory legitimacy, and enormous capital, but it also changes the dynamics: liquidity will deepen, volatility may compress, and strategic long-term holding will outweigh short-term speculation.

2. Scarcity Will Become a Global Narrative

Bitcoin’s fixed supply of 21 million coins has always been its rallying cry. But over the next five years, scarcity could evolve from a meme to a mainstream investment thesis.

- Each Bitcoin halving event—where mining rewards are cut in half—tightens new supply. The next halving, expected in 2028, will make the asset even rarer.

- As more coins move into cold storage and institutional vaults, circulating liquidity will shrink, further accentuating scarcity.

- Nation-states and corporate treasuries may follow pioneers like El Salvador and MicroStrategy, treating Bitcoin as a strategic reserve asset.

Scarcity plus institutional demand creates a perfect storm of upward pressure, potentially catapulting Bitcoin into the financial mainstream like never before.

3. The Rise of Digital Ownership and Financial Sovereignty

Perhaps the most underestimated transformation is not just financial—but cultural. The next generation of wealth holders, entrepreneurs, and creators is growing up with self-custody, decentralized finance, and tokenized assets as default mindsets.

- The concept of owning your private keys—and by extension, your wealth—will become second nature to digital natives.

- Innovations like layer-2 networks, smart contract bridges, and decentralized identity will blur the lines between Bitcoin’s base layer and broader Web3 ecosystems.

- This will give rise to a world where individuals can own and transfer assets globally without intermediaries, creating new forms of entrepreneurship, investment, and financial inclusion.

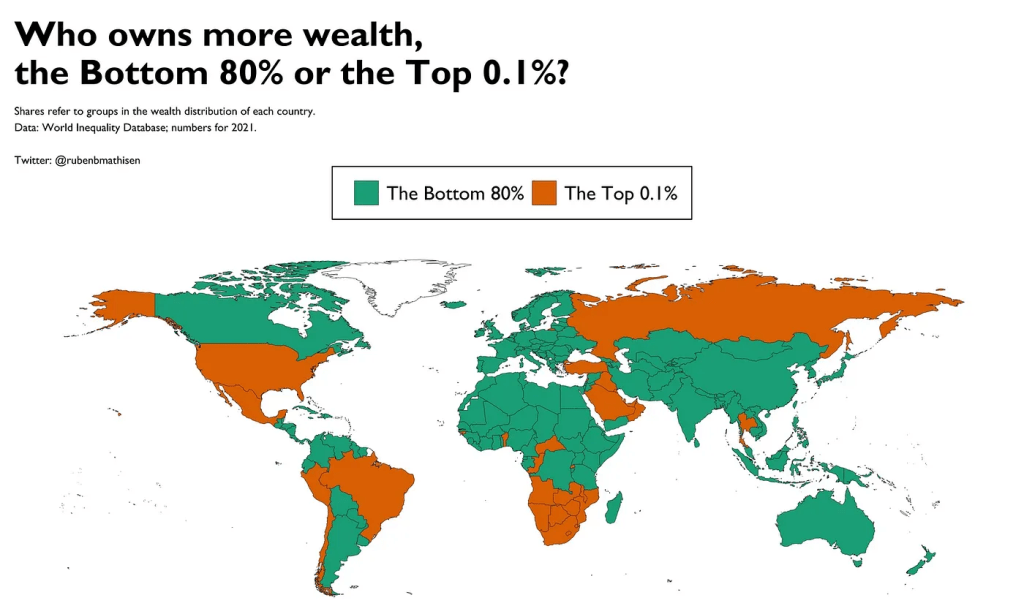

Over five years, this shift could reshape the global distribution of power—moving it away from centralized financial institutions and toward the hands of individuals and communities.

4. Regulation Will Bring Both Risk and Credibility

Global regulators are no longer ignoring Bitcoin. The coming years will see a wave of policy frameworks—some supportive, others restrictive.

- Clear rules could unlock trillions in institutional capital that are currently sidelined due to compliance concerns.

- However, overregulation or fragmented policies could push activity offshore, creating jurisdictional competition and uneven adoption.

The winners will be jurisdictions that strike the right balance between consumer protection, innovation, and open access—and Bitcoin will thrive where freedom and innovation converge.

5. A Global Reset of What Money Means

Perhaps the biggest impact of the coming five years will be philosophical. As fiat currencies face inflationary pressures and central banks explore Central Bank Digital Currencies (CBDCs), Bitcoin will stand out as a neutral, decentralized, borderless alternative.

This will ignite a profound question for societies worldwide:

“If money can be created endlessly, what does it mean to truly own something?”

Bitcoin’s next chapter will force both individuals and institutions to rethink the very foundations of value, trust, and sovereignty.

The Bottom Line: A Decade Defined by Bitcoin

The past decade made Bitcoin famous.

The next five years could make it foundational.

As capital, talent, and technology converge, the world is on the cusp of a Bitcoin Renaissance—a period where this once-niche experiment matures into a pillar of the global financial system.

Whether you’re an investor, innovator, or observer, one thing is certain:

The next five years will be unlike anything we’ve seen—and they’ll change how the world thinks about money forever.