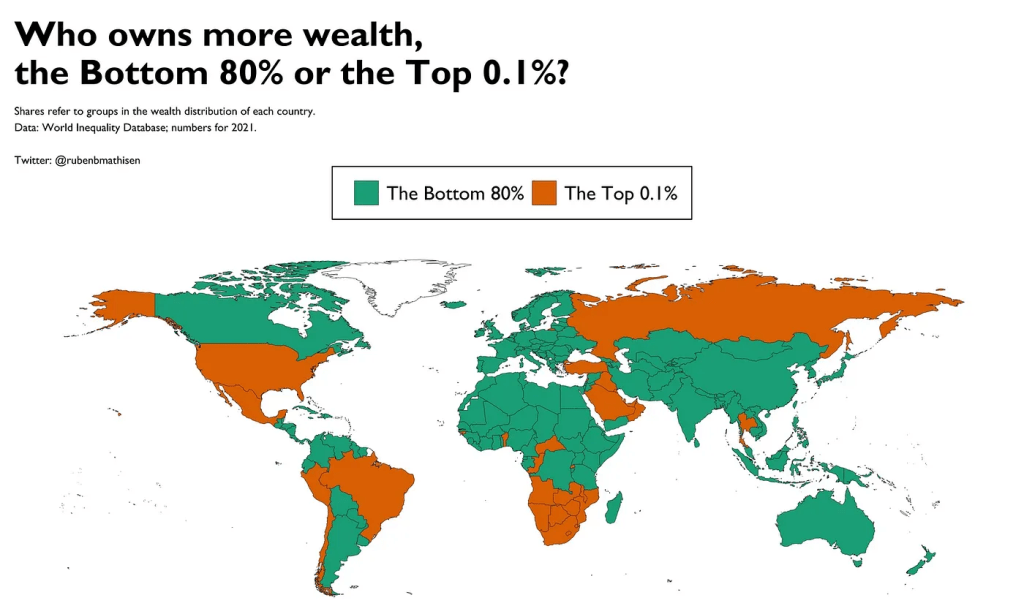

When we think about wealth, we all believe we have some idea of where we stand. We imagine the “wealthy elite” as billionaires on magazine covers, the “middle class” as ordinary professionals in developed countries, and the “poor” as those struggling in less developed economies. But the truth is far more surprising—and in many ways, far more uncomfortable.

The reason? Our perception of wealth is broken.

Most of us dramatically overestimate how much wealth the average person has, and underestimate how extraordinary even “ordinary” savings or property can look on a global scale. The gap between perception and reality is staggering, and two simple questions can reveal just how misunderstood the landscape of global wealth really is.

The Two Questions That Expose Our Blind Spots

Let’s run a thought experiment.

- What percentage of adults in the world own more than $10,000 in assets?

- How many people on Earth do you think qualify as millionaires (assets above $1 million)?

Take a guess before reading on.

Most people imagine that at least half the world has $10,000 in assets. And when asked about millionaires, guesses often range in the tens or even hundreds of millions.

The reality?

- Roughly 70% of adults worldwide own less than $10,000 in total assets.

- Just 1% of people globally qualify as millionaires.

That means if you own more than $100,000 in property, savings, or investments, you’re not middle class—you’re in the top 10% globally.

And if you’re a millionaire in net worth, congratulations—you are among the rarest 1% of humanity. What feels “ordinary” in one country is “extraordinary” in the world.

The Global Wealth Pyramid

The clearest way to see this imbalance is through what economists call the “global wealth pyramid.” According to Credit Suisse’s latest Global Wealth Report:

- Bottom 50% of adults — control just 2% of total global wealth. That’s half of humanity living with almost nothing in terms of assets.

- Next 40% — together hold about 38% of the wealth, spread thinly across billions of people.

- Top 10% — control nearly 60% of all wealth on Earth.

- Top 1% — hold more wealth than the entire bottom 90% combined.

This isn’t just inequality—it’s concentration at an extraordinary scale. Imagine a room of 100 people representing the world. One person in the corner controls more wealth than the other 90 people put together.

Why Do We Misunderstand Wealth So Badly?

The numbers are shocking, but the real question is: why are most people so wrong in their assumptions?

There are a few key reasons:

- Relative Perspective

Humans compare themselves to those around them. If you live in a developed country, you measure your situation against neighbors, coworkers, or the national middle class—not against a farmer in rural India or a street vendor in Nigeria. - Media Distortion

Our conversations about wealth are dominated by outliers—billionaires, CEOs, tech moguls. We think the global distribution is full of millionaires because we hear about them constantly. But for every billionaire story, there are billions living with little or no safety net. - Psychological Anchoring

We anchor wealth to local currencies and costs of living. A small apartment in London or New York might feel modest, but on paper, it still represents assets that put the owner in the top tier globally. - The Invisible Poor

Global poverty is less visible in wealthy nations. In developed countries, even those struggling often have access to infrastructure, credit, and services that obscure just how massive the disparity is.

The Historical Context

Wealth concentration is not new. Empires and kingdoms throughout history often had extreme inequality. What makes today unique is that inequality exists in a globally connected economy. A millionaire in San Francisco competes for assets with a rising middle-class worker in Shanghai, a tech entrepreneur in Nairobi, and a farmer in Brazil who just got access to digital banking.

Globalization has made the wealth pyramid sharper and more transparent. And now, with data flowing freely, it’s impossible to ignore the gap.

Why This Matters for the Future

Understanding the true distribution of wealth isn’t just an academic exercise—it has massive real-world consequences:

- For policymakers: Extreme concentration of wealth drives political instability, populism, and distrust in institutions. A fragile global balance depends on addressing inequality not only within nations, but across them.

- For investors: Knowing where real wealth sits highlights where growth will come from. The future isn’t in saturated Western economies, but in billions of people in emerging markets moving from the bottom of the pyramid into the middle.

- For individuals: Recognizing your true place in the global wealth pyramid changes your mindset. If you’re saving, investing, and building assets—even modestly—you’re already ahead of the majority.

The Uncomfortable Truth

Here’s the uncomfortable truth: if you’re reading this on a laptop or smartphone, with access to the internet and disposable income, you are almost certainly among the wealthiest people on the planet.

What you might consider “just getting by” would be viewed as unimaginable luxury by billions of others.

And this gap matters—because as wealth continues to concentrate, those with even modest savings or investments have an opportunity to position themselves in ways billions cannot.

Final Thought

Most people are dead wrong about global wealth because we see it through a distorted lens. We think locally, but the real story is global. And the global story is shocking: wealth is rare, fragile, and unevenly distributed.

The numbers don’t just surprise—they should inspire action.

If you’re building wealth, even slowly, you are ahead of most of the world. If you’re investing, you’re already part of the global elite. And if you’re aware of the reality, you have the ability to navigate the future far more intelligently than those who still believe the myths.

The pyramid is real. And once you see it clearly, you can’t unsee it.