Few investors command market attention like Warren Buffett. When Berkshire Hathaway amasses an extraordinary level of cash and short-term U.S. Treasuries—often described in headlines as a “warning” to markets—investors across asset classes take notice. For Bitcoin investors, Buffett’s long-standing skepticism toward cryptocurrencies, combined with Berkshire’s defensive positioning, raises an important question: what does Buffett’s caution really mean for Bitcoin right now?

This article cuts through the hype to offer a professional, balanced analysis. Rather than framing Buffett as “right” or “wrong,” we examine what his actions signal about macroeconomic risk, how those signals differ from Bitcoin’s investment thesis, and what disciplined Bitcoin investors should actually do in response.

Understanding Buffett’s Cash Strategy

Berkshire Hathaway’s massive cash and Treasury holdings are not a market-timing gimmick. They reflect Buffett’s core philosophy:

- Capital preservation comes first. Buffett prefers holding cash when he believes assets are mispriced or risks are asymmetric.

- Patience is a weapon. Cash gives Berkshire the flexibility to act decisively during market stress.

- Opportunity cost matters less than permanent loss. Buffett is willing to underperform in bull markets to avoid catastrophic losses in downturns.

In short, Buffett’s cash position is less a prediction of imminent collapse and more a signal that at current prices, he does not see enough margin of safety in many traditional investments.

Why Buffett Rejects Bitcoin

Buffett’s criticism of Bitcoin is consistent and philosophical, not emotional. His objections typically fall into three categories:

- Lack of intrinsic cash flow – Bitcoin does not generate earnings, dividends, or rent.

- Non-productive nature – Unlike businesses or farmland, Bitcoin does not produce goods or services.

- Speculative demand – Buffett believes most buyers expect to sell to someone else at a higher price, rather than hold for utility.

From a classical value-investing lens, these critiques are internally logical. Buffett evaluates assets based on discounted future cash flows, a framework Bitcoin intentionally does not fit into.

Where Buffett’s Framework and Bitcoin Diverge

Bitcoin investors often misunderstand Buffett by assuming his framework should apply universally. In reality, Bitcoin represents a different category of asset altogether.

Bitcoin as Monetary Infrastructure, Not Equity

Bitcoin is better understood as:

- A monetary network, similar to gold rather than a company

- A store-of-value experiment in a world of expanding fiat supply

- A censorship-resistant settlement layer, not a productive enterprise

Expecting Bitcoin to behave like a stock misses its purpose. Gold, for example, produces no cash flow either—yet Buffett’s own mentor, Benjamin Graham, acknowledged its role as a monetary hedge.

Macro Signals Bitcoin Investors Should Take Seriously

While Buffett may dismiss Bitcoin itself, his macro caution contains signals that Bitcoin investors should not ignore.

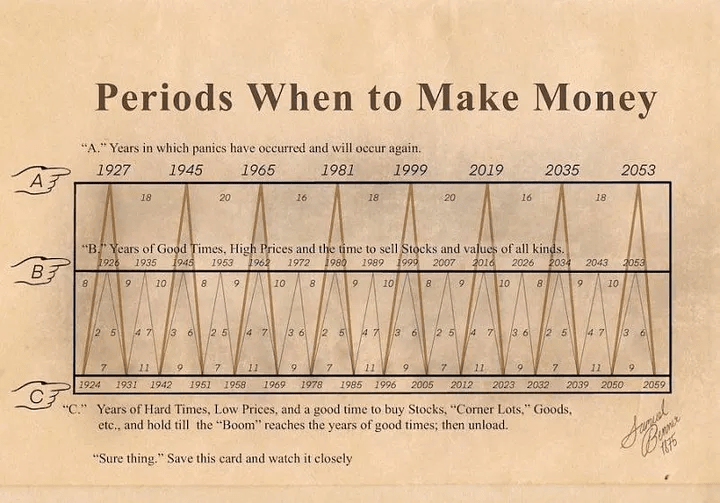

1. Liquidity Cycles Matter

Buffett’s defensive stance suggests tighter financial conditions or elevated valuation risk. Bitcoin has historically been sensitive to global liquidity:

- Expanding liquidity tends to support risk assets, including Bitcoin

- Tightening liquidity often leads to volatility and drawdowns

Ignoring macro liquidity because Bitcoin is “different” is a costly mistake.

2. Leverage Is the Real Enemy

Buffett’s philosophy is deeply anti-leverage. For Bitcoin investors, this lesson is critical:

- Overleveraged positions amplify volatility

- Forced liquidations, not fundamentals, cause the worst crashes

Long-term Bitcoin adoption has survived multiple cycles, but leveraged speculation repeatedly destroys capital.

What Buffett’s Warning Does Not Mean for Bitcoin

It is equally important to clarify what Buffett’s caution does not imply:

- It does not invalidate Bitcoin’s fixed supply

- It does not negate institutional or sovereign interest in digital assets

- It does not mean Bitcoin must follow equity market valuations

Buffett’s reluctance to buy Bitcoin does not prevent others from using it as a hedge against monetary debasement or geopolitical risk.

A Disciplined Framework for Bitcoin Investors

Professional Bitcoin investors can extract value from Buffett’s mindset without copying his asset choices.

Adopt Buffett’s Discipline, Not His Portfolio

- Demand a margin of safety in your own positioning

- Avoid narrative-driven FOMO

- Prioritize survivability over maximum upside

Separate Short-Term Price From Long-Term Thesis

Bitcoin’s long-term thesis—scarcity, decentralization, and monetary neutrality—remains independent of short-term macro fear. However, price volatility is the cost of admission.

Conclusion: Interpreting the Signal Correctly

Warren Buffett’s enormous cash position is best understood as a warning about risk, not innovation. His skepticism toward Bitcoin reflects a value-investing framework optimized for productive assets, not a definitive judgment on alternative monetary systems.

For Bitcoin investors, the real takeaway is not to abandon conviction—but to strengthen discipline. Respect liquidity cycles. Avoid leverage. Prepare for volatility. In doing so, investors can remain aligned with Bitcoin’s long-term potential while navigating the very risks Buffett has spent a lifetime avoiding.

In that sense, Buffett’s warning may be less about Bitcoin’s failure—and more about how investors should survive long enough to see any thesis succeed.