There is no doubt that the SEC crackdown affected crypto and Bitcoin is not an exception. Bitcoin is already down by 15% from its all time highs in 2023. It enjoyed a high of about $31,000. Crypto exchanges such as Coinbase and Binance admit the SEC crackdown accelerated the sell off of bitcoin.

Even though bitcoin has dropped by 15%, it is still enjoying a 60% profit. This may be an indication there is a bitcoin bull cycle coming up. Some of the reasons to support this hypothesis include:

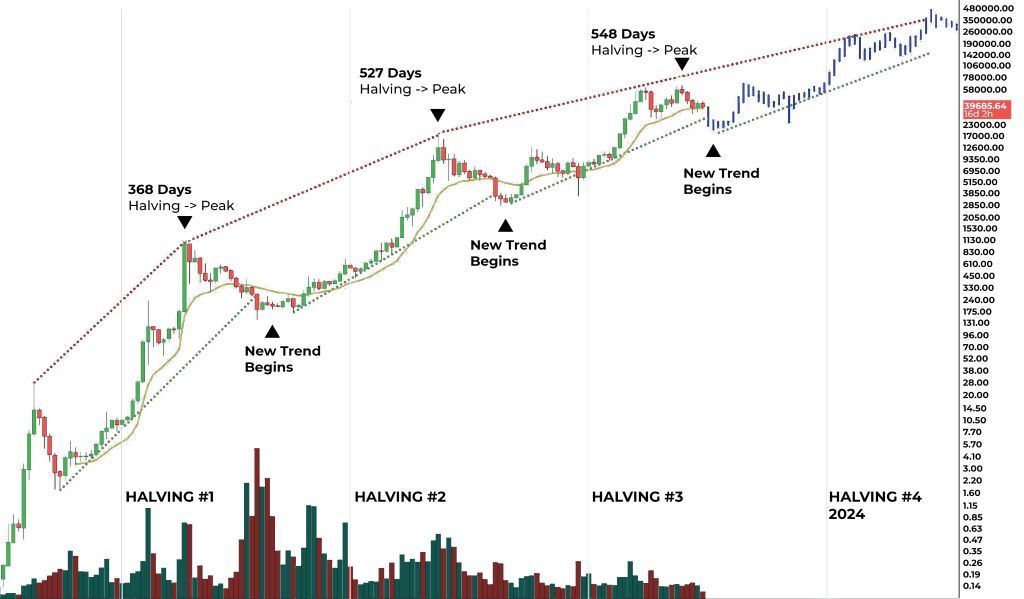

Bitcoin halving

This happens every four years whereby the coin supply rate is halved. The next bitcoin halving is set to happen in April 2024. The previous halvings happened in 2012, 2016 and 2020. In all the events, there was a BTC price rally that led to all time highs. Currently btc is high by 276% from the l;ast halving event in 2020. Current;y the market is working in anticipation of the next halving event.

BlackRock Bitcoin ETF

Blackrock has filed an application with the SEC for a bitcoin exchange traded fund. This will boost the reputation of BTC leading to an increased demand priori to the halving event.

It is highly likely that the SEC will approve BlackRock;s application. The investment firm has a good history when it comes to ETF records with the SEC. The SEC promised to respond to the firm by March 2024, which is a month before the halving.

According to Crypto Tea, an analyst, BlackRock was strategic in its application as it knew the supply will decrease and the demand increase. The investment firm wanted to capture the market before competition.

Rise in Bitcoin dominance

The recent SEC crackdown worked in favor of Bitcoin as there are many altcoins that were thrown out, especially those that were classified as unregistered securities. This increased bitcoin dominance to over 50%. The SEC recognizes altcoins as securities, which is not the case with Bitcoin. This made bitcoin be considered as a safe bet when compared to altcoins.

Michael Saylor from MicroStrategy has seen this coming as he predicted the SEc will push BTC market cap to 80% of the total crypto market. The move will eliminate any confusion and doubts from institutional investors.

Bitcoin bull flag

According to technical charts, bitcoins show a bull flag pattern in the long term, which suggests there will be an increasing continuation of its recovery rally.

The bull flag will get resolved once the price goes higher above its upper trendline. This will bring the bitcoin bull flag to near $35,500, which was a support level between May 2021 and May 2022.

To start a bull cycle, bitcoin will have to close above $35,500, as long as it remains lower than the previous bear market peaks.

Apart from the bull flag pattern, BTC price could be on the verge of a breakout in the inverse-head-and-shoulder(IH&S) pattern. This is a bullish reversal pattern which can only be resolved when price breaks above the neckline and rises such that the distance between the neckline and the middle trough’s lowest point is the same.

If there will be a rebound from the IH&S neckline, BTC could rally up the prices by more than 60% towards $40,500.

Did you like this post? Do you have any feedback? Do you have some topics you’d like me to write about? Do you have any ideas on how I could make this better? I’d love your feedback!

Feel free to reach out to me on Twitter!