The Power of Small, Steady Investments

When most people think about investing in Bitcoin, they imagine big, risky bets — lump sums, wild swings, and sleepless nights. But the truth is, you don’t need to gamble your life savings to benefit from Bitcoin’s long-term potential.

In fact, you could start with as little as $10 a month — and by 2030, that small, steady habit could have a life-changing impact.

1. The Power of Dollar-Cost Averaging (DCA)

Dollar-cost averaging is a time-tested investment approach where you invest a fixed amount at regular intervals, regardless of the asset’s price.

This method removes emotion from investing — you buy through the highs and the lows, letting time and compounding work in your favor.

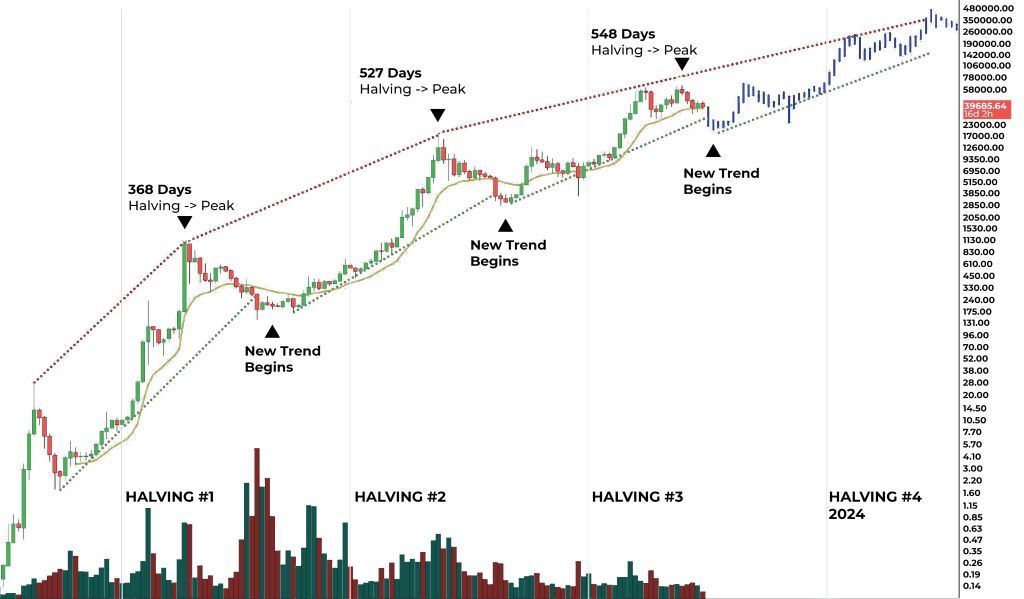

In Bitcoin’s case, DCA has historically been a powerful strategy because it turns volatility from a fear into an advantage. You’re not trying to “time the market”; you’re simply showing up, month after month.

2. Why $10 Matters More Than You Think

At $10 per month, you’re committing $120 a year. Over a decade, that’s $1,200 total invested — less than the cost of a daily coffee habit.

But Bitcoin’s historical performance changes the equation. While no future returns are guaranteed, Bitcoin’s compound annual growth rate (CAGR) since inception has been extraordinary, even accounting for deep drawdowns.

Let’s take a conservative example:

If Bitcoin grows at 20% CAGR from now until 2030 (much lower than its past average), your $1,200 total contributions could grow to several multiples of your original investment — without you ever making a large commitment.

3. Bitcoin’s Scarcity Advantage

Unlike fiat currency, Bitcoin has a fixed supply of 21 million coins. This scarcity is hardcoded into its protocol. As adoption increases and demand rises, supply cannot be inflated to meet it. That’s why long-term holders — whether they own thousands of dollars or just a few satoshis — share the same benefit of scarcity.

With micro-investing, you are essentially stacking small amounts of a finite asset before the rest of the world realizes its true value.

4. Benefits of Starting Small

- Low Risk Entry — You’re not overexposed; small amounts keep your risk manageable.

- Habit Formation — Regular investing builds discipline, which pays off in other financial areas.

- Upside Exposure — Even small positions in high-growth assets can become meaningful over time.

- Accessible to All — You don’t need to be wealthy to participate in the Bitcoin network.

5. The Bigger Picture: 2030 and Beyond

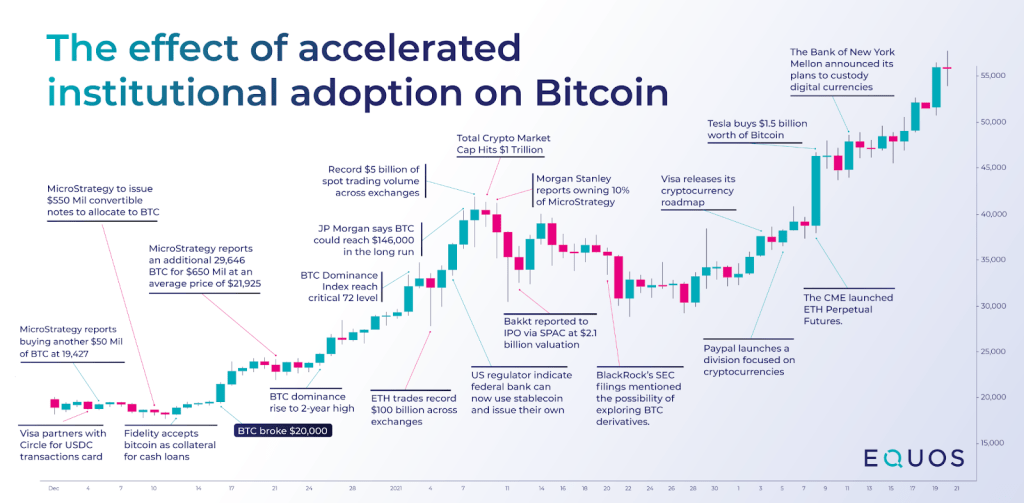

Bitcoin adoption is still in its early stages, with growing interest from institutional investors, nation-states, and global payment platforms. By 2030, it could play a central role in global finance.

If that happens, the price could reflect not just speculation, but deep, fundamental demand for a digital, borderless, inflation-resistant store of value.

The $10 a month you start today isn’t just an investment — it’s a ticket to participate in the future monetary system.

We tend to overestimate what we can do in a day, but underestimate what we can do in a decade.

Ten dollars a month won’t change your life overnight, but with patience, discipline, and the compounding effects of Bitcoin’s scarcity, it could be one of the smartest financial moves you ever make.

Small steps, big future.

Start stacking.