The crypto market has experienced exponential growth over the past decade, transforming from a niche concept to a trillion-dollar industry. As we embark on the second decade of crypto, the landscape is poised for further evolution. This article delves into the potential trends that will shape the crypto space from 2024 to 2028, covering institutional adoption, regulatory developments, technological enhancements, and the rise of new sectors like decentralized finance (DeFi) and Non-fungible Tokens (NFTs).

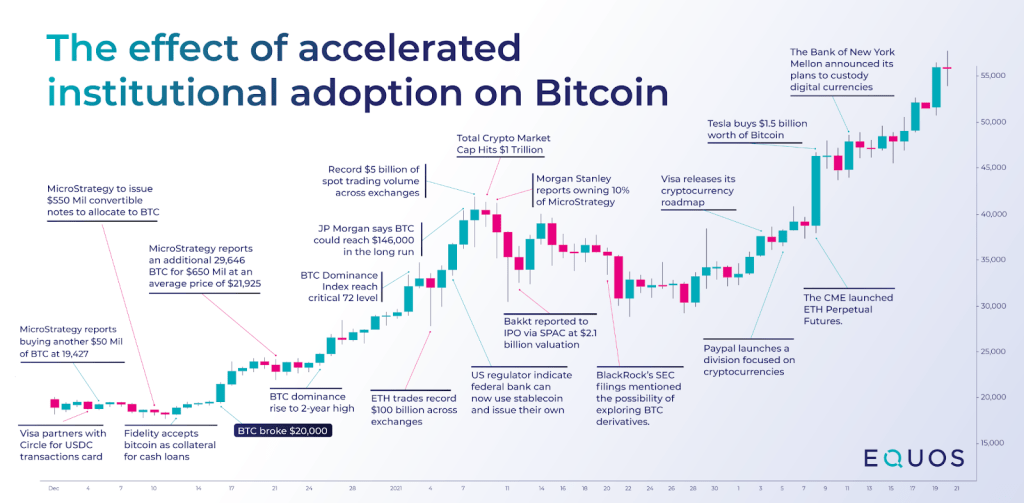

- Institutional Adoption of Crypto: Institutional interest in crypto has surged in recent years, and this trend is expected to intensify from 2024 to 2028. Major financial institutions, including banks, hedge funds, and pension funds, are entering the crypto space. This acceleration can be attributed to crypto gaining mainstream acceptance as a legitimate asset class. Regulated investment products like Bitcoin ETFs and futures contracts provide easier exposure, fostering portfolio diversification and attracting institutional investors seeking higher returns.

The anticipated institutional adoption aligns with the Rogers Technology Adoption Lifecycle, transitioning from early adopters to the early majority stage. This shift signifies a massive influx of capital from diverse institutions, contributing to the maturation of the crypto market.

2. Crypto Regulatory Trends: Regulatory developments will play a pivotal role in shaping the crypto landscape from 2024 to 2028. As the global crypto industry is projected to surpass $5 trillion by 2028, regulatory clarity is crucial. Anticipated trends include the establishment of global regulatory frameworks by entities such as the Basel Committee, IOSCO, and the FSB. These frameworks are expected to focus on standards for custody and asset management, consumer protection, and AML/counterterrorism financing regulations.

Moreover, jurisdiction-specific regulations will play a significant role, with countries taking varied approaches, ranging from complete bans to progressive embracing of crypto. The emergence of decentralized governance models will also gain prominence, reducing dependency on centralized regulators.

3. Technological Improvements, DeFi, and NFT Growth: The next four years are poised to witness significant technological advancements in scalability and interoperability solutions. Ethereum’s transition to sharding and the implementation of Layer 2 protocols will enhance transaction throughput, reducing fees and enabling micro-transactions at scale. Interoperability solutions like those offered by Polkadot and Cosmos will facilitate the seamless transfer of liquidity and assets across blockchains.

Simultaneously, the decentralized finance (DeFi) ecosystem is expected to witness substantial growth. The sector, already boasting over $60 billion in locked capital, is projected to reach over $497.9 billion in transaction value by 2032. DeFi’s expansion is attributed to its accessibility to global retail investors, transparent protocols, and censorship-resistant features.

The Non-fungible Token (NFT) market is set to experience a CAGR of 30.23% between 2023 and 2028, reaching a market size of USD 68.16 billion. NFTs are evolving beyond digital art collectibles to represent ownership of various virtual items across art, collectibles, gaming, and the metaverse. Interoperability protocols will facilitate the movement of NFTs across different virtual worlds, enhancing their utility.

As we navigate the crypto landscape from 2024 to 2028, the industry stands at the intersection of institutional adoption, regulatory evolution, technological innovation, and the growth of new sectors. While risks persist, the measured approach taken by institutions and regulators reflects a maturing industry. The true potential of crypto, underpinned by blockchain technology, is set to become increasingly mainstream, paving the way for a transformative decade ahead.

Did you like this post? Do you have any feedback? Do you have some topics you’d like me to write about? Do you have any ideas on how I could make this better? I’d love your feedback!

Feel free to reach out to me on Twitter!