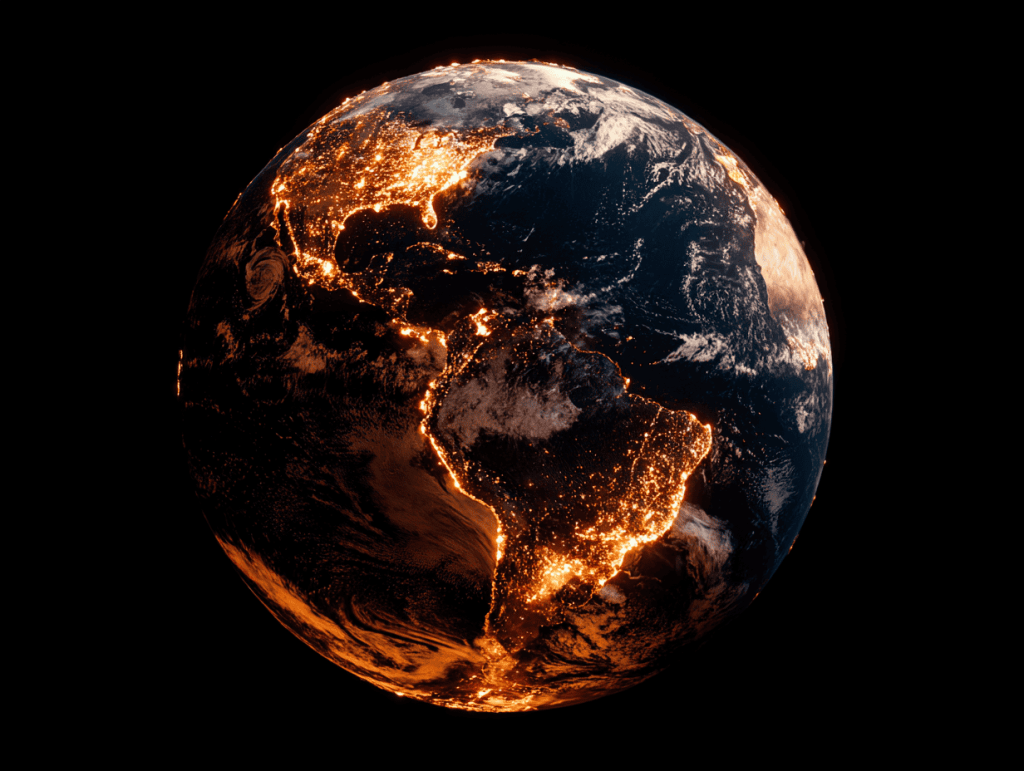

If the world burned tomorrow, most people would turn on the news.

The ultra-rich would head straight for the bunkers they already built.

For years, billionaires were obsessed with Mars colonies, metaverses, and the next big moonshot. But something has shifted. Their behavior is no longer driven by flashy ambition — it’s driven by caution. And in their world, caution is rarely for nothing.

Look closely at what they’re actually doing. Jeff Bezos has been liquidating billions in Amazon stock, even as the company continues strong. Elon Musk has repeatedly cashed out Tesla shares despite claiming unshakable confidence in the company. Google’s founders, once famous for holding tight through every storm, have quietly sold off major stakes. These aren’t panicked moves — they’re strategic. The richest people in the world are prioritizing liquidity, not loyalty. Money you can move is more valuable than money trapped inside a volatile future.

At the same time, the wealthiest are no longer buying luxury — they’re buying resilience. Mark Zuckerberg’s Hawaii compound is rumored to include secure underground areas, and it’s not the only one of its kind. New Zealand officials have publicly complained about billionaire land grabs fueled by interest in remote safety havens. Private islands, secured estates, hardened shelters — these are not status symbols. They are continuity plans.

And while the public is encouraged to build stock portfolios and “trust the system,” the ultra-rich are buying the system’s fundamentals. Farmland. Water rights. Critical infrastructure. Supply chain choke points. Bill Gates has quietly become the largest private farmland owner in the United States — not for fun, and not for scenery. Food and water are power in a future defined by scarcity.

They are acting like the next decade will not look like the last.

Not because they have a secret prophecy. Because they have the best data on the planet — from geopolitical threat forecasting to climate trend modeling to macroeconomic stress indicators. They see pressure building in every direction: automation threatening jobs faster than new ones appear, global supply chains stretched to breaking, political institutions struggling to contain polarization and distrust, and climate events shifting from rare to routine.

Stability was a privilege of the past. Volatility is what’s next.

Your financial advisor tells you to buy the dip. Billionaires are making sure they don’t fall with it. They aren’t scared of losing wealth — they’re scared of losing control, safety, and autonomy. So they’re preparing for a future where those things are no longer guaranteed by governments, markets, or society.

The truth is simple: the ultra-rich aren’t smarter, just earlier. They act before everyone else realizes what’s happening. If their behavior looks unusual, it’s because the future they see coming isn’t business as usual.

Most people will wait to react until the headlines make the danger obvious. The people with the most to lose — they’re reacting now.