Past, Present, and Future of the World’s Most Important Monetary Innovation

Bitcoin was born on January 3, 2009, in the aftermath of a global financial collapse that exposed the fragility of centralized monetary systems. Embedded in Bitcoin’s Genesis Block was a quiet but powerful statement referencing the bailout of banks, signaling that this new system was designed as an alternative to monetary mismanagement, political interference, and inflationary finance. What began as a white paper shared by the pseudonymous Satoshi Nakamoto has, seventeen years later, become a cornerstone of the global financial conversation.

Bitcoin’s early years were defined by vision rather than recognition. In a world that believed money required trust in institutions, Bitcoin introduced trust in mathematics, cryptography, and open-source consensus. It functioned without leaders, companies, or governments, operating continuously while critics dismissed it as impossible or irrelevant. Through each block mined, Bitcoin demonstrated that digital scarcity could exist without a central authority. The hard limit of 21 million coins transformed money from something that could be printed endlessly into something governed by transparent, unchangeable rules.

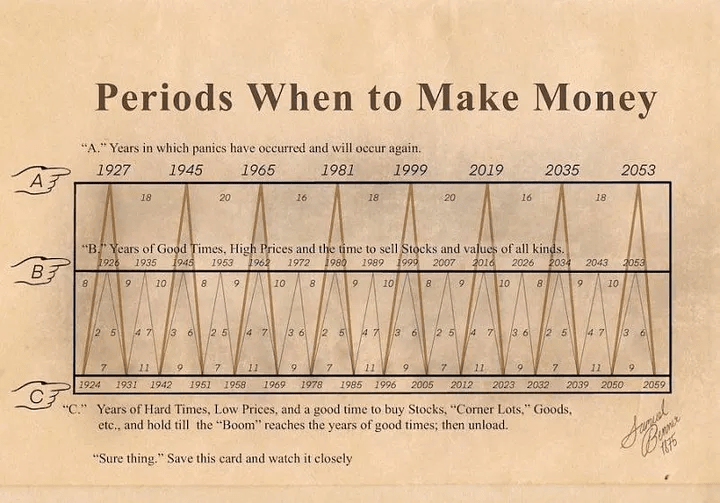

As Bitcoin matured, it survived every challenge placed in front of it. Market crashes, regulatory uncertainty, hostile narratives, and technological scrutiny failed to disrupt the protocol. Instead, Bitcoin grew stronger with each cycle. Its proof-of-work mechanism anchored the digital world to physical reality through energy, creating the most secure computing network ever built. By simply continuing to function, Bitcoin earned trust not through promises, but through performance.

Today, Bitcoin stands as a global monetary asset and a digital form of sound money. It is increasingly recognized as digital gold, offering superior portability, divisibility, and verifiability compared to any store of value that came before it. Institutions, corporations, and long-term investors now treat Bitcoin not as speculation, but as protection against currency debasement and systemic risk. Financial products built around Bitcoin have opened access to traditional capital markets, further cementing its role within the global financial system.

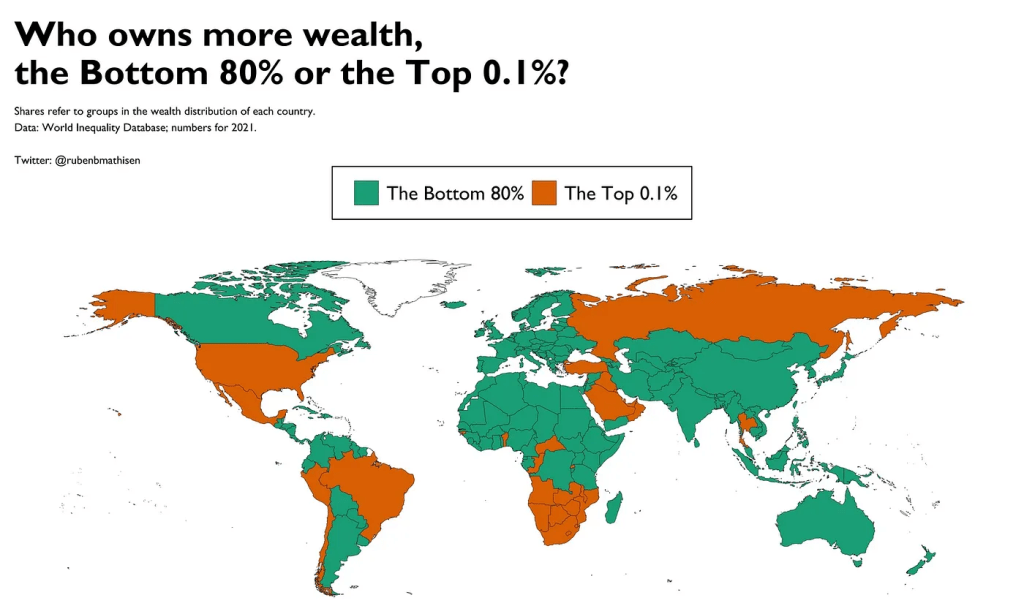

At the same time, Bitcoin remains open and permissionless. Anyone with an internet connection can use it, save in it, or transmit value across borders without reliance on banks or intermediaries. In regions suffering from inflation, capital controls, or financial censorship, Bitcoin serves as a lifeline. It allows individuals to preserve the value of their labor and participate in the global economy on equal terms. Scaling innovations such as the Lightning Network have expanded Bitcoin’s utility beyond savings, enabling fast and low-cost payments while preserving the security of the base layer.

Looking ahead, Bitcoin’s future is defined by inevitability rather than speculation. Fiat currencies are structurally designed to lose purchasing power, while Bitcoin is engineered to become more scarce over time. As adoption increases and supply remains fixed, Bitcoin continues to absorb value from weaker monetary systems. This process is gradual, but relentless. Over the coming decades, Bitcoin is positioned to become a global reserve asset, a neutral settlement layer, and a foundation for long-term capital preservation.

Nation-states are beginning to recognize Bitcoin not as a threat, but as a strategic asset. Its neutrality makes it uniquely suited for a multipolar world where trust between governments is limited. Bitcoin offers a monetary standard that no single entity can control, manipulate, or weaponize. At the same time, its integration with energy infrastructure is reshaping how power is produced, distributed, and monetized, turning wasted energy into secured economic value.

Bitcoin’s greatest strength lies in what it does not require. It does not depend on confidence in leadership, political stability, or economic forecasts. It depends only on code, incentives, and consensus. Every year that Bitcoin continues to operate without interruption reinforces its credibility. At seventeen years old, Bitcoin has outlived its critics, surpassed expectations, and redefined what money can be.

Bitcoin is not just a technological achievement. It is a peaceful revolution. It is a system that rewards patience, responsibility, and long-term thinking. It represents the separation of money from centralized control, just as the internet separated information from gatekeepers. Its story is still being written, block by block, and its impact will be measured not in years, but in generations.

Happy 17th Birthday, Bitcoin.

You are no longer an experiment.

You are monetary history in motion.