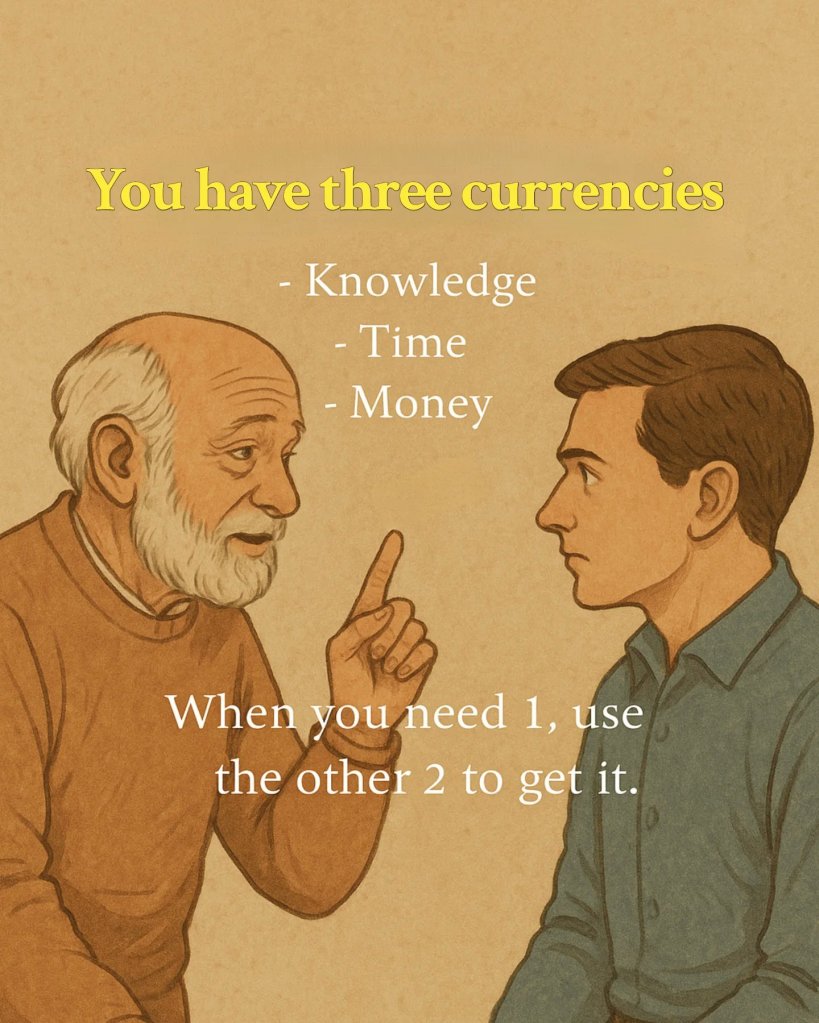

In life, everyone is given access to three core currencies: time, money, and knowledge. How you invest and exchange these will define your growth, your freedom, and ultimately—your legacy.

1. Time: The Only Non-Renewable Resource

You can earn money. You can gain knowledge.

But time? Once it’s gone, it’s gone forever.

Every moment you spend is an investment. The question is: Are you investing it or wasting it?

Wasting time on low-value distractions or delaying action is like burning cash—only worse. Time has compounding power when used wisely. Whether you’re building a skill, a business, or a relationship, time is your most valuable asset.

2. Money: A Tool, Not a Goal

Money is a magnifier. It amplifies your choices and enables freedom—but it’s not freedom itself. Too often, people chase money at the cost of their time and health, only to realize they’ve traded away what really matters.

The goal isn’t to hoard money, but to use it wisely:

- Buy back your time.

- Invest in your growth.

- Enable opportunities for yourself and others.

When money works for you, not the other way around, you’re playing the game right.

3. Knowledge: The Multiplier

Knowledge turns time into mastery and money into opportunity. It’s the multiplier for everything else in life.

Unlike time, knowledge compounds.

Unlike money, knowledge can’t be taken from you.

And when shared, it grows, not depletes.

Read. Learn. Ask. Surround yourself with smarter people. In the long run, it’s not who works the hardest, but who learns fastest that wins.

Final Thought: Be Wise. Balance Ruthlessly.

The smartest people understand this:

- Use money to buy time.

- Use time to gain knowledge.

- Use knowledge to grow money—and value.

Time, money, knowledge. Master the exchange. Play long-term. Win with wisdom.