The world of cryptocurrency has come a long way since the inception of Bitcoin. What was once considered a fringe movement for tech enthusiasts and cypherpunks has now entered the mainstream. The most recent crypto ownership survey by Finbold reveals that 10.2% of the global internet-using population owns some form of cryptocurrency. While retail adoption is noteworthy, what’s even more intriguing is the rising interest from institutions, particularly in the realm of Web3 and digital assets. In this article, we’ll explore the institutional adoption of cryptocurrencies, including trends, challenges, and what the future may hold.

Institutional Interest in Cryptocurrency

The rise of Web3, characterized by decentralization, privacy, and blockchain technology, has piqued the interest of institutional players, including Fortune 500 companies. According to a report by The Block, 52% of Fortune 500 companies have explored Web3 initiatives. While the “institutions are coming” narrative has been circulating for years, recent developments suggest a more tangible shift.

Bitcoin ETFs: A Game Changer?

One of the most optimistic developments is the filing of a Bitcoin ETF by BlackRock, a leading global investment manager. Despite previous rejections by the SEC, Bloomberg analysts predict a 65% chance of approval for this ETF. This application marks a significant step toward bridging the gap between traditional finance and the crypto space. A successful Bitcoin ETF could open the floodgates for institutional capital.

Crypto Assets Under Management (AUM) on the Rise

Cryptocurrencies are no longer just a curiosity; they are viewed as a legitimate asset class. Digital asset management review by CCData indicates that the total AUM for digital asset investment products reached $33.7 billion in July 2023, up from $22 billion a year ago. This increase is impressive, considering the challenges the crypto market faced, including the Terra collapse.

Bitcoin-based products dominate the institutional space, accounting for 71% of the market share. Ethereum-based products come second, constituting 22% of the market.

U.S. Dominance in AUM, Fueled by Grayscale

The U.S. has yet to approve a Bitcoin ETF, but institutional investors are showing a significant appetite for Bitcoin and Ethereum-based products. Over 70% of the capital in the U.S. flows through Grayscale, a crypto asset manager offering exposure to Bitcoin through the Grayscale Bitcoin Trust (GBTC). As of July 2023, GBTC’s AUM stood at $18.6 billion.

The recent narrowing of the GBTC discount, influenced by ETF applications, suggests growing institutional demand. When the discount narrows, it indicates increasing demand for the GBTC trust, indicating institutional accumulation.

Hedge Funds: Navigating Risk and Reward

Hedge funds, which experienced a challenging year in the crypto market in 2022, are cautiously optimistic about 2023. While the number of hedge funds investing in crypto assets dropped from 37% to 29%, 93% of them expect higher crypto market valuations in 2023 compared to the previous year. Hedge funds are also diversifying their investments beyond Bitcoin, exploring niche products and altcoins.

DeFi and the Gradual Shift

Decentralized Finance (DeFi) has gained traction, with traditional institutions like JPMorgan conducting DeFi transactions on public blockchains. The number of hedge funds using decentralized exchanges (DEXs) has been steadily increasing, with Uniswap, dydx, Curve, Sushiswap, and Pancakeswap among the top choices.

Family Offices: Growing Interest

Family offices are showing increased interest in digital assets, with 56% of them already investing in cryptocurrencies. While they currently allocate a small percentage of their wealth to digital assets, over 35% plan to increase their exposure in the future.

Bitcoin in the Boardroom

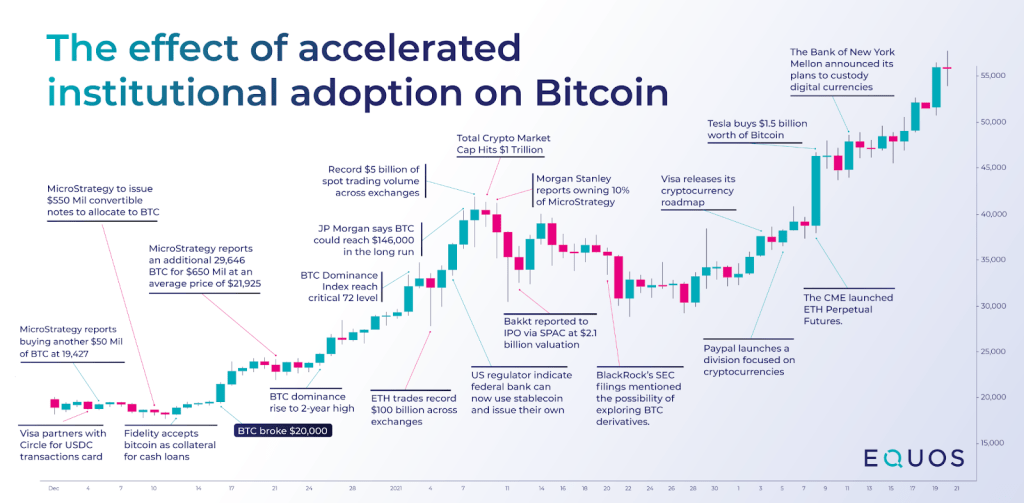

Publicly traded companies have also entered the crypto arena, with firms like Microstrategy, Tesla, and Coinbase investing in Bitcoin. Microstrategy, in particular, holds a substantial amount of Bitcoin, with its CEO, Michael Saylor, being a prominent Bitcoin advocate.

NFT Collections: Enhancing Digital Presence

NFTs are not only about art and collectibles; they offer a new way for institutions to engage with the digital realm. Nike, for instance, has partnered with EA Sports to integrate NFT-designed apparel into video games. Fortune 100 companies have generated $1.6 billion in secondary sales from digital collections.

The Awaited Bitcoin ETF

The question of whether the U.S. SEC will approve a Bitcoin ETF remains paramount. BlackRock’s application has sparked optimism, but past rejections cast a shadow of uncertainty. However, if approved, the ETF could significantly impact the crypto market, given BlackRock’s $9 trillion in AUM.

Major Hurdles in Institutional Adoption

Two major hurdles remain for institutional adoption: regulation and crypto custody. Regulatory uncertainty continues to challenge the industry, with evolving compliance costs. Custody remains a critical concern, as recent hacks highlight the importance of secure storage solutions.

Institutional adoption of cryptocurrencies is still in its early stages, with many opportunities and challenges ahead. As the regulatory landscape evolves and security measures strengthen, the institutional presence in the crypto space is expected to expand. The trends discussed in this article offer a glimpse into the future of finance, where traditional institutions and digital assets coexist and collaborate.

Did you like this post? Do you have any feedback? Do you have some topics you’d like me to write about? Do you have any ideas on how I could make this better? I’d love your feedback!

Feel free to reach out to me on Twitter!